News & information

Economics

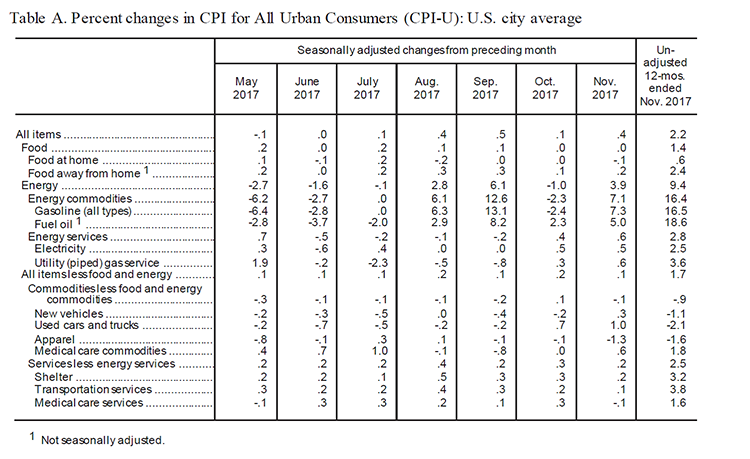

The Bureau of Labor Statistics released its November numbers for the Consumer Price Index for all Urban Workers (CPI-U) today. The CPI-U rose 0.4 percent in November, and increase of 0.3 percentage points from October’s increase of 0.1 percent.

Over the last 12 months, the all-items index rose 2.2 percent, indicating a steady increase in inflation over the last year. The main causes of the increases were rising energy prices, which rose 3.9 percent in November after falling 1 percent in October and amounted to a 9.4 percent increase over the last year. Food prices were unchanged in November, with the prices of food consumed at home even declining 0.1 percent.

While the CPI-U increased 0.3 percentage points over October, core inflation (all items less food and energy) only increased 0.1 percent, a slowdown from the October rate of 0.2 percent. Part of the decline can be attributed to a sharp decrease in the apparel index (-1.3 percent), the largest single-month drop since September 1998.

Growth in the shelter index slowed, from 0.3 percent in October to 0.2 percent in November and the prices for medical care services also declined. The below table from the BLS shows the price changes for various key indices.

The release of the November CPI is the latest data that informed the Federal Open Market Committee (FOMC) of the Federal Reserve to raise its benchmark short-term interest rate (the federal-funds rate) at the conclusion of its two-day policy meeting Wednesday afternoon. The FOMC voted to raise the benchmark rate from 1.25 percent to 1.5 percent, the fifth such increase since the Fed began raising rates from zero in December 2015.

However, the decision is controversial among economists, who fear that this policy move could stall growth, and many have urged caution on rates to further jump-start inflation.

The price index for personal-consumption expenditures (the Fed’s preferred measure of inflation) rose 1.6 percent in October, well below the Fed’s 2.0 percent target.

Both the CPI and the personal consumption index follow the same pattern. Apart from large increases in energy prices, the November CPI numbers indicate that underlying core inflation continues to be muted.

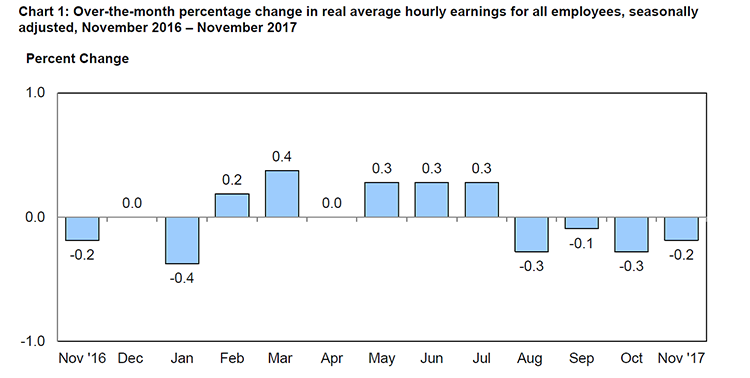

There is also room for wages to grow without generating higher rates of inflation, even with the official unemployment rate at a 17-year low of 4.1 percent in November. Data on real earnings released by the BLS today show that average hourly earnings decreased 0.2 percent from October to November. A 0.2 percent increase in average hourly earnings, coupled with a 0.4 percent increase in the CPI, accounts for the net decrease.

Real average weekly earnings increased 0.1 percent, an increase of 0.6 percentage points over the last year. Wage growth has been tepid since November 2016, with a 2.5 percent increase in average hourly earnings (0.2 percent real) and 3.1 percent increase in average weekly earnings (0.8 percent real).

The below graph from the BLS shows the over-the-month percentage change in real average hourly earnings since November 2016.