News & information

Pay tables, COLA info, annuity projections

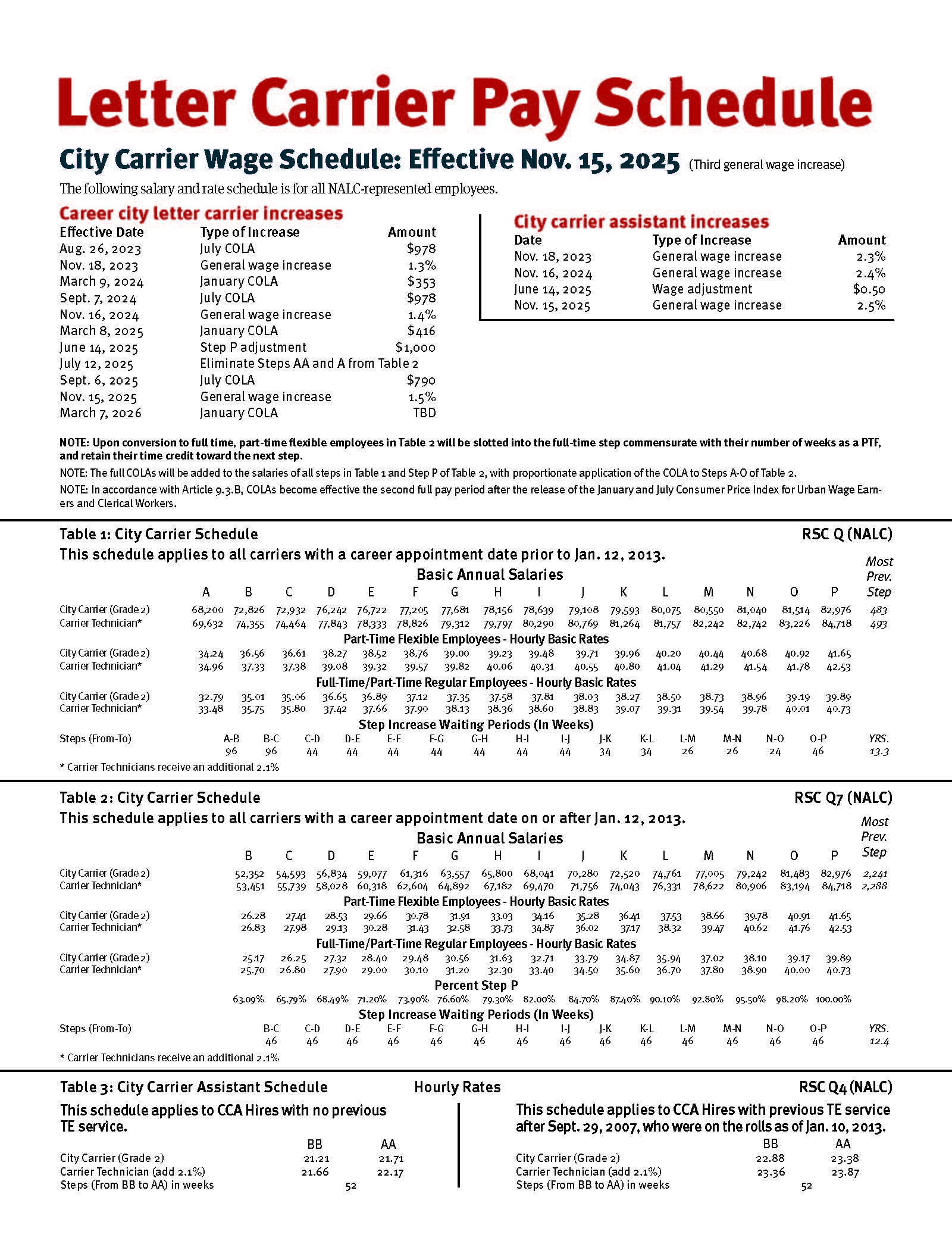

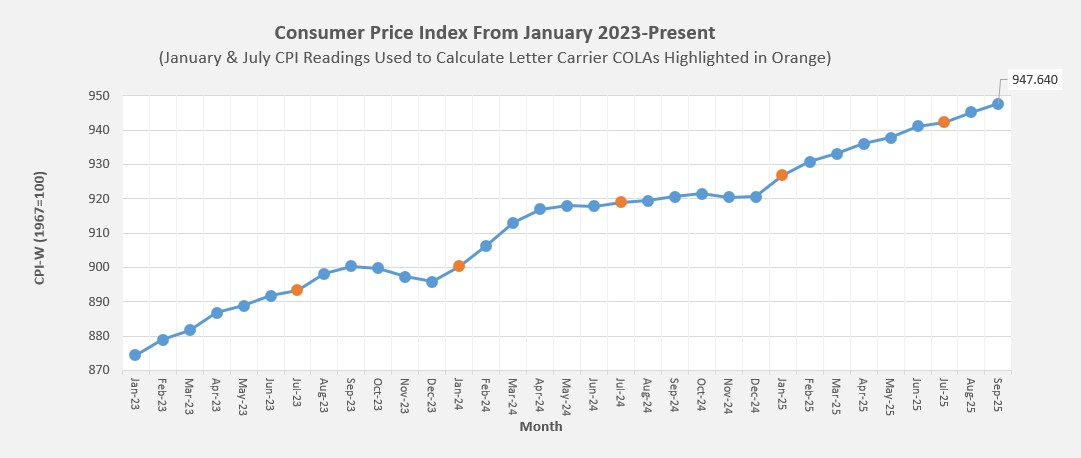

This page contains the latest information on current NALC pay tables, NALC contract cost-of-living adjustments (COLAs) and FERS and CSRS annuity projections. The page also contains a graph showing changes to the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers, the index used to calculate Cost of Living Adjustments (COLA) that apply to active and retired carriers.

You also will find information about Postal Service performance and information about developments in the postal sector generally.

Letter carrier pay table

2023-2026 National Agreement

Under the terms of the 2023-2026 National Agreement between the National Association of Letter Carriers and the United States Postal Service, this salary and rate schedule is the paychart for all NALC represented employees effective Nov. 15:

Click the table above to open it as a PDF

Selected previous National Agreement pay tables are available below.

Cost-of-living adjustments (COLAs)

—click on image to see a larger version (opens a new window)

February 2026 cost-of-living adjustment memo

February 13, 2025

6th Contract COLA: COLA is $250

The sixth regular COLA under the 2023-2026 National Agreement is $250 in February following the release of the January 2026 Consumer Price Index.

On February 13, 2026, the Bureau of Labor Statistics announced that the CPI for Urban Wage Earners and Clerical Workers (CPI-W, 1967=100) stood at 947.051 in January, 72.61 points above the base level of 874.441 in January 2023. The accumulated COLA through January stood at 12 cents per hour or $250 annually.

2027 Retiree COLAs: CSRS is 0.2% and FERS is 0.2% as of February 2026

The 2027 COLAs for CSRS and FERS benefits are based on the increase in the average CPI-W between the 3rd quarter of 2025 (317.265) and the 3rd quarter of 2026.

Based on the January 2026 CPI-W (1982-84) of 317.942, the increase in the CPI is 0.2%. The projected 2027 COLA for CSRS is 0.2% and FERS is 0.2%. The 2028 retiree COLA calculation will be finalized in October 2026 with the release of the CPI-W for September 2026.

2026 FECA COLA: 0.2% through February 2026

Based on the release of the January 2026 CPI-W (1982-84=100), the 2026 FECA COLA is 0.2%. The January 2026 CPI-W of 317.942 was 0.2% above the December 2025 base index (317.414). The 2027 FECA COLA calculation will be finalized when the December 2026 CPI-W is published during the month of January 2027.

FECA COLAs are applicable only in cases where death or disability occurred more than one year prior to the adjustment’s effective date.

CSRS and FERS annuity projections

Latest on the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers

Information on the CPI can be found on the Department of Labors Bureau of Labor Statistics' web page.